In this brave new world of ours in 2011, many of us are finding the need to become braver and smarter in light of current economic conditions. While some folks worry over possible job layoffs, health care and home foreclosures, life goes on for others. For those seeking general home maintenance or possible home improvements in an effort to protect one of the largest investments in their lives, they may find a more difficult row to hoe than in years past in order to securing financing. It’s easy to get excited when planning any renovation to your home, but it may be wise to have a solid budget set in advance of your project’s start date and make sure your loan officer is on board before going to the next step of hiring a contractor to complete the work for you. While it’s difficult to know how much a project will cost you without speaking to a contractor first, in this day and age – it’s better to know what you can afford first and then ask the contractor to work within your budget.

According to a recent article in the Chicago Tribune, new government regulations, tighter restrictions and higher mortgage rates are dampening the optimism for many would-be home buyers. Therefore, more and more homeowners are continuing to make the choice to stay put and make do with what they have. However, there are certain steps you can take to help ensure the likelihood of securing a loan for your next home improvement or maintenance project:

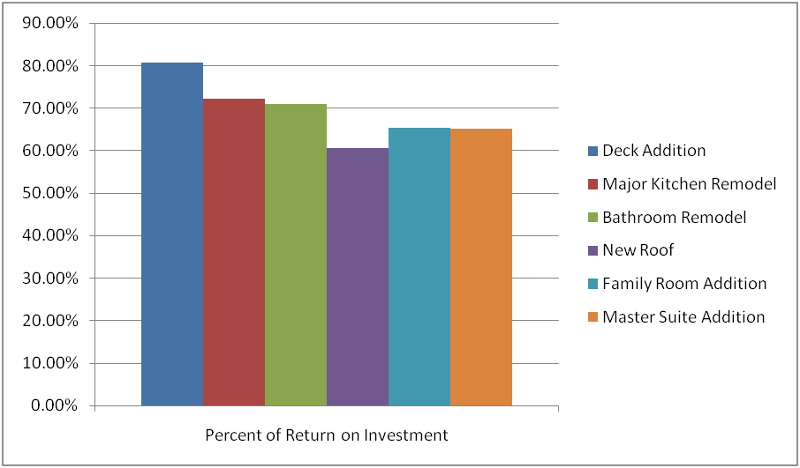

- Choose wisely – Lenders are more likely to look favorably upon projects that have a historically high return on investment. In a “Cost vs. Value” study conducted by Remodeling Magazine in 80 metropolitan markets across the nation, the projects with the largest return on investment included:

- Deck Addition

- Kitchen Remodel

- Bathroom Remodel

- New Roof

- Family Room Addition

- Master Suite Addition

- Space it out – While it’s wonderful to imagine tackling all of your dream projects at once and coming away with an entirely “good as new” home, it may not be practical from a financial standpoint. For the time being, homes are not the assets they once were and (hopefully) will be again. Consider taking on just one or two projects at a time. List them in order of importance from a personal standpoint as well as a return on investment perspective. What do you and your family need RIGHT NOW, and what can you live without for a little while longer? By paying off your loan seamlessly, chances are your lender will be likely to extend another loan your way in the future so you can take on the next project on your wish list.

- Do Your Homework – Research all of the different lending institutions such as banks, credit unions, mortgage lenders, and private lenders – as well as different loan possibilities – like conventional home equity loans, equity lines of credit and personal lines of credit. Dig around to make sure you don’t fall victim to fraudulent lending practices. The Federal Trade Commission suggests that you DON’T:

- Sign on to a home equity loan if you don’t have enough income to make the monthly payments.

- Sign anything you haven’t read thoroughly.

- Feel pressured to sign anything before you’ve had a chance to read it.

- Agree to a loan that includes credit insurance or other “add-ons” that you don’t want.

- Know The Score – The Federal Trade Commission also indicates that it’s wise to know your credit score before sitting down in front of a lender so there are no less than pleasant surprises. The Fair Credit Reporting Act (FCRA) requires each of the nationwide consumer reporting companies — Equifax, Experian, and TransUnion — to provide you with a free copy of your credit report, at your request, once every 12 months. A credit report includes information such as where you live, how you pay your bills, and whether you have been sued, served jail time, or have filed for bankruptcy. Nationwide consumer reporting companies then sell the information in your report to creditors, insurers, employers, and other businesses that use it to evaluate your applications for credit, insurance, employment, renting an apartment, or securing a home loan. To order, simply visit annualcreditreport.com, call 1-877-322-8228, or complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- Don’t Become Discouraged – History has shown that time has an amazing way of healing all things. If you are unable to secure a loan for a home improvement project at this time, be sure to do what it takes to clean up your credit score in the meantime and start saving your pennies for the future. All is not lost – you’ve done the research necessary to find a good lender and contractor, you know exactly what you want to do, and when the time comes – you’ll be prepared to make your dreams a reality. In the event that you are able to secure a loan, be sure to work with a reputable contractor who gets the work done on time and on budget.

When you’re ready to begin on your general maintenance or home improvement project, we hope you will contact Highlight Home Restoration to discuss your design and building plans with you. We will do our level best to work within your budget while exceeding your expectations. To reach us, simply call 678-873-9234, e-mail us at info@highlighthomesga.com or fill out our convenient online contact form. To learn more about us and all of our services, we invite you to visit us online at www.highlighthomesga.com. We wish you the very best of luck in securing your loan and eagerly await your call!

Sources: Podmolik, Mary Ellen. “Would-be buyers could find it harder to get into a home in 2011” Chicago Tribune. http://articles.chicagotribune.com/2011-01-01/classified/ct-biz-0102-outlook-housing-20110101_1_michael-fratantoni-mortgage-rates-mortgage-market January 1, 2011. “Cost vs. Value Report 2009-2010” Remodeling Magazine. http://www.remodeling.hw.net/2009/costvsvalue/national.aspx “Home Equity Loans: Borrowers Beware” Federal Trade Commission. http://www.ftc.gov/bcp/edu/pubs/consumer/homes/rea11.shtm